child tax portal says not eligible

The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible. If you did not receive the payment and the payment was not returned you may request the IRS to trace the payment.

Child Tax Credits 2021 What To Do If You Don T Get Your Payment Today

Review your payments in the Child Tax Credit Update Portal to ensure the payment was not returned.

. The children must also have lived with the person whos claiming for more than half of the tax year and be claimed as a dependent on the tax return. If it is determined the payment was not received or was returned to the IRS IRS records will be updated and you can exclude the payment from the. There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021.

It will allow them to claim both the enhanced child tax credit and stimulus payments they may have missed according to CNN. The enhanced child tax credit which hasnt been extended for 2022 sent eligible parents monthly payments totaling up to 3600 for each child in. Previously the refundable portion was limited to 1400 per child.

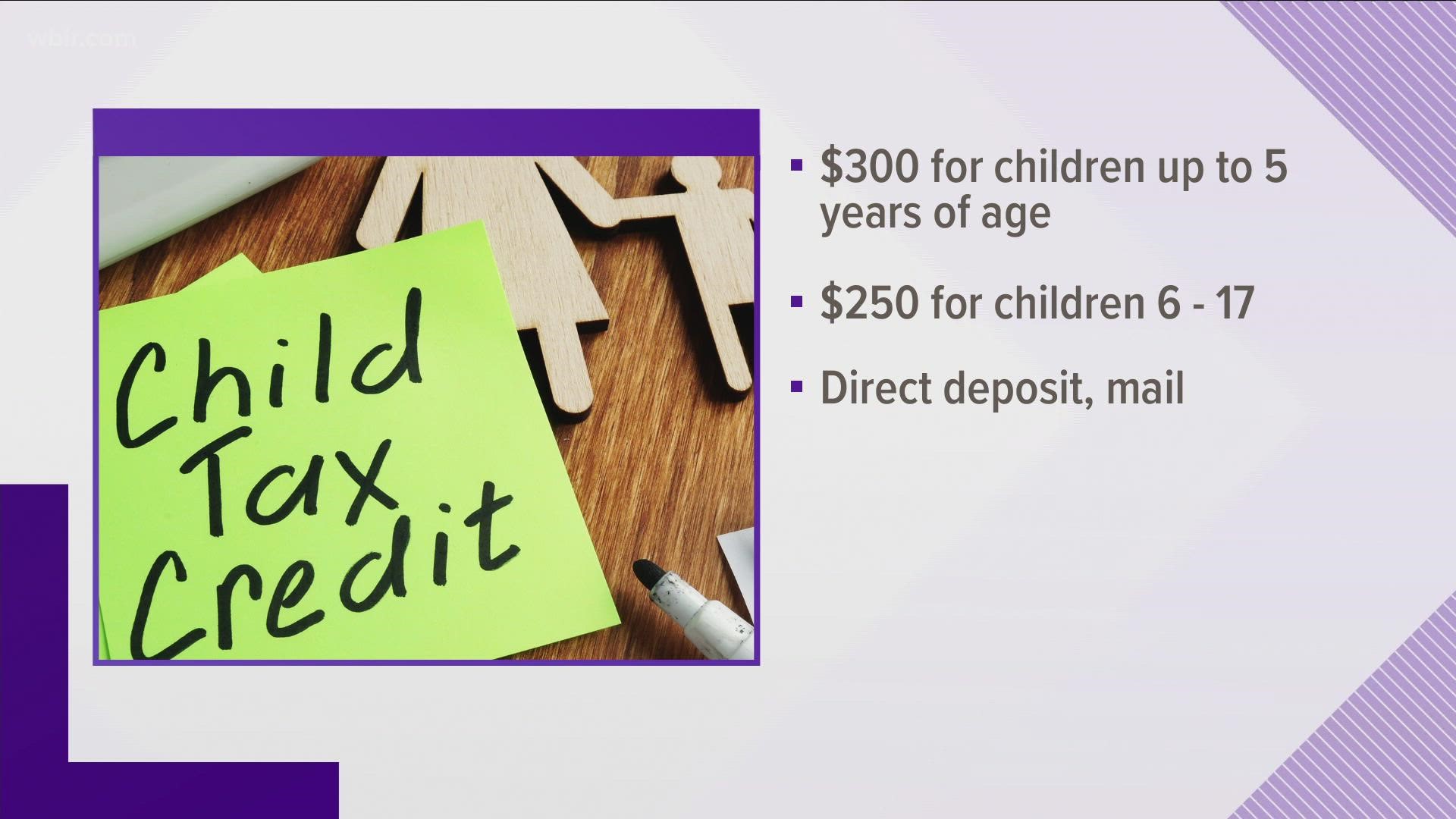

The legislation will among other things increase the child tax credit to 3000 per child ages 6 to 17 and 3600 annually for children under 6 for the tax year 2021. The IRS this summer is sending letters to 36 million families notifying them they may be eligible to receive monthly child tax credit payments. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November.

The child tax credit CTC is available to parents of minor children. This means that eligible families can get it even if they owe no federal income tax. Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on.

As tax season begins millions of U. And experts say its important it documents how. Without the expansion the child tax credit is reverting back to its previous levels -- a maximum credit of 2000 per child under age 17 that phases in.

A portal has been established to reach low-income households that do not typically file taxes. The IRS will use 2019 tax returns if a 2020 return has not been filed or processed yet. Households with Children are receiving.

The entire credit is fully refundable for 2021. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021.

Pin By Michelle Faulkenberg On Housing Emergency Assistant Rental

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

Insurance Premium Tax Benefits Life Insurance Premium Income Tax Return File Income Tax

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Where Is My September Child Tax Credit 13newsnow Com

Missing A Child Tax Credit Payment Here S How To Track It Cnet